Buying a home is an exciting journey, but it’s also one of the biggest financial decisions you’ll make. Avoiding common mistakes when buying a home in Maryland is extremely important to save you from unnecessary stress and financial pitfalls.

Whether you’re a first-time homebuyer or an experienced buyer, knowing what to look out for can help you make a smart investment.

In this article we will go over the most common mistakes you need to avoid when buying a home in Maryland.

What to Avoid When Buying a Home in Maryland

1. Skipping Mortgage Pre-Approval

One of the biggest mistakes homebuyers make is house-hunting before getting pre-approved for a mortgage.

Pre-approval gives you a clear idea of your budget, strengthens your offer, and speeds up the buying process.

✅ First KNHome Group Tip: Talk to multiple lenders to compare mortgage rates and terms before committing to one.

2. Not Researching the Neighborhood

Falling in love with a house is easy, but don’t forget to research the neighborhood.

Factors like school districts, commute times, crime rates, and future development plans all impact long-term satisfaction and resale value.

✅ Second KNHome Group Tip: Visit the area at different times of the day and talk to neighbors to get real insights.

3. Overlooking Additional Costs

Many buyers focus solely on the home price. Most buyers forget about additional costs like property taxes, HOA fees, insurance, and maintenance expenses.

These can add up quickly and affect your overall affordability.

✅ Third KNHome Group Tip: Use a mortgage calculator that includes these extra costs to get a realistic monthly payment estimate.

To use our FREE Mortgage Calculator tool just click here.

4. Letting Emotions Drive the Decision

Buying a home is exciting, but emotional decisions can lead to overpaying or settling for a home that doesn’t truly meet your needs.

✅ Fourth KNHome Group Tip: Keep a list of must-haves vs. nice-to-haves and stick to it when touring homes.

5. Neglecting a Home Inspection

Skipping a home inspection can lead to costly surprises down the road.

Issues like roof damage, plumbing leaks, or foundation problems may not be visible at first glance.

✅ Fifth KNHome Group Tip: Always hire a professional inspector, even for new construction homes.

6. Making Big Financial Changes Before Closing

Many buyers don’t realize that major financial moves.

Important aspects like switching jobs, opening new credit accounts, or making large purchases—can negatively impact their mortgage approval. This is extremely important because it can affect your chances of getting a loan commitment. Please always talk to your loan officer before making a big financial decision.

✅ Sixth KNHome Group Tip: Keep your finances stable until after you close on your home.

7. Not Considering Resale Value

While you may plan to stay in your new home for years, life changes happen.

Ignoring resale value factors like location, layout, and home condition could make it harder to sell later.

✅ Seventh KNHome Group Tip: Choose a home with strong long-term value, even if you’re not thinking about selling yet. Our trusted real estate team can help you determine future apperication.

8. Ignoring First-Time Homebuyer Programs

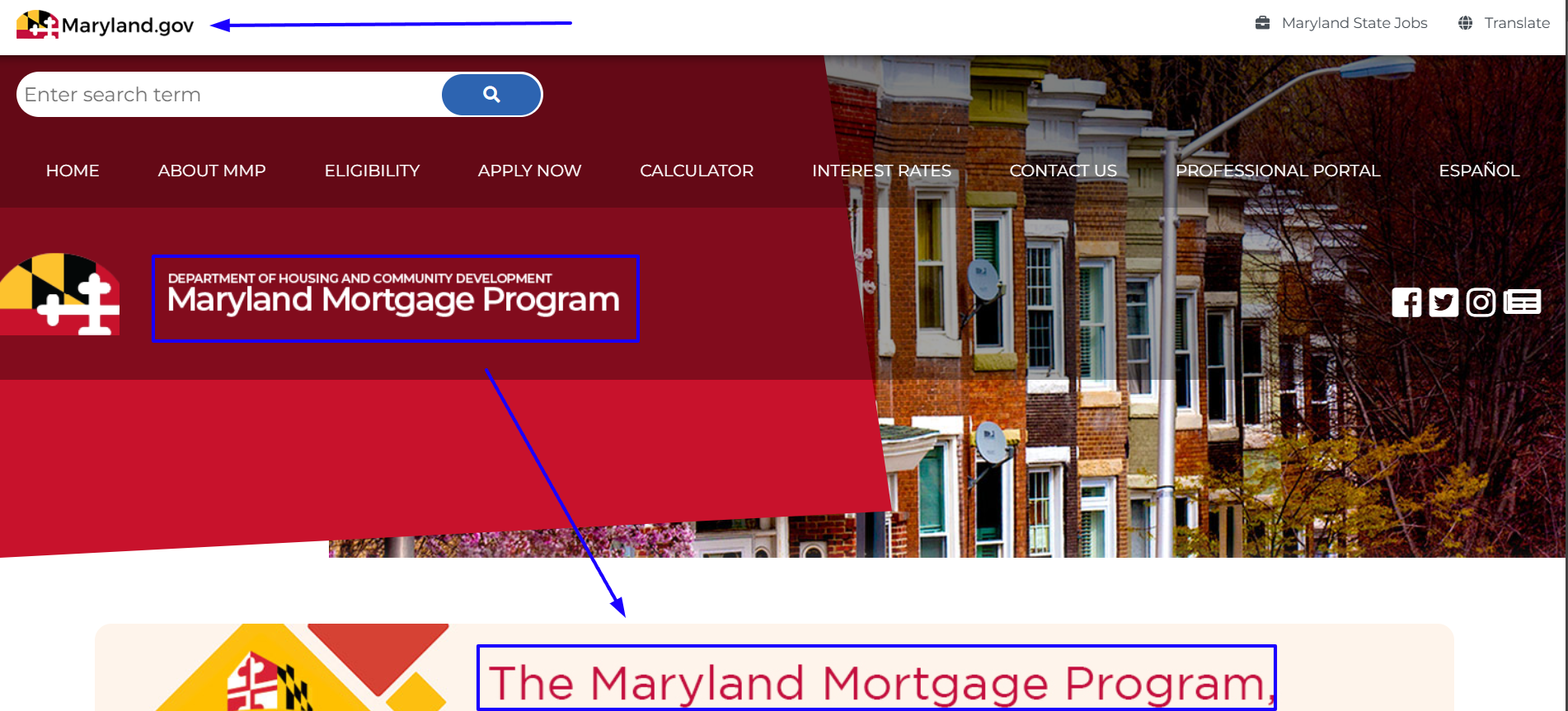

Maryland offers several first-time homebuyer programs that provide down payment assistance and tax credits.

Many buyers miss out on these opportunities simply because they don’t research them.

✅ Eighth KNHome Group Tip: Check the Maryland Mortgage Program (MMP) and other local assistance options. Always ask your loan officer of grant or down-payment assistance programs that may be available.

To access the Maryland Mortage Program (MMP) Website simply click here.

9. Failing to Work with an Experienced Agent

Some buyers think they can navigate the process alone to save money. Who you work with matters, especially during the negotiation and escrow process.

However, a good real estate agent can help you negotiate better deals, avoid costly mistakes, and handle all paperwork efficiently.

✅ Ninth KNHome Group Tip: Work with a local Maryland agent who understands the market and can guide you through the entire process.

To contact a Local Real Estate Expert click here.

10. Rushing the Homebuying Decision

It’s easy to feel pressured in a competitive market, but rushing into a purchase without considering all aspects can lead to regrets.

✅ Tenth and Last KNHome Group Tip: Take your time, review all details, and ensure the home meets your needs before making an offer.

FAQs: Mistakes When Buying a Home in Maryland

What is the biggest mistake first-time homebuyers make?

One of the most common mistakes is not getting pre-approved for a mortgage. Without pre-approval, buyers may fall in love with homes they can’t afford or struggle to get their offers accepted.

How can I avoid overpaying for a home in Maryland?

Research comparable home sales in the area, work with a local real estate agent, and avoid making impulsive offers above market value.

Is it necessary to hire a home inspector?

Yes! Our team always recommends not skipping this step. A home inspection can uncover hidden issues that could cost you thousands in repairs after purchase.

What costs should I budget for beyond the home price?

Factor in closing costs, property taxes, homeowners insurance, maintenance, and possible HOA fees.

Maryland Homebuying Mistakes Conclusion

Avoiding these common mistakes when buying a home in Maryland can save you time, money, and stress.

Whether you’re a first-time buyer or experienced homeowner, making informed decisions will help you find the right home with confidence.

💡 Next Steps: Ready to buy your dream home? Contact us today to get started!

Next Steps for Maryland Homebuyers

If you’re ready to start your home search professionally, contact KN Home Group today.

Our team is ready to help you find the dream home that matches all your needs.