If you are looking to buy a house in Maryland, knowing where to start and the steps is crucial.

Buying a home in Maryland is an exciting but complex process.

Whether you’re a first-time buyer or looking to relocate, understanding the steps to buy a home in Maryland can help you make informed decisions.

In this guide, we’ll walk you through everything you need to know to find and purchase your dream home

Step 1: Assess Your Financial Readiness

Before diving into the home search, evaluate your finances. Consider your savings, credit score, and debt-to-income ratio.

This is why speaking with a lender is important. Even if you are not ready, a loan officer can help guide you in the right direction.

A strong financial foundation will help you secure better mortgage terms.

Step 2: Get Pre-Approved for a Mortgage

This step is crucial. A mortgage pre-approval gives you an idea of how much you can afford and makes you a more competitive buyer.

To get pre-approved, you’ll need to provide:

- Proof of income (pay stubs, tax returns)

- Credit history

- Debt and asset information

- Employment verification

At KNHomeGroup we provide Homebuyers with a Mortage Calculator for free.

To access our Mortgage Calculator tool click here.

Step 3: Find an EXPERT and LOCAL Real Estate Agent

A qualified Maryland real estate agent will help you navigate the homebuying process.

This includes negotiating offers, and finding properties that match your criteria.

Look for an expert agent familiar with the local market and homebuyer incentives.

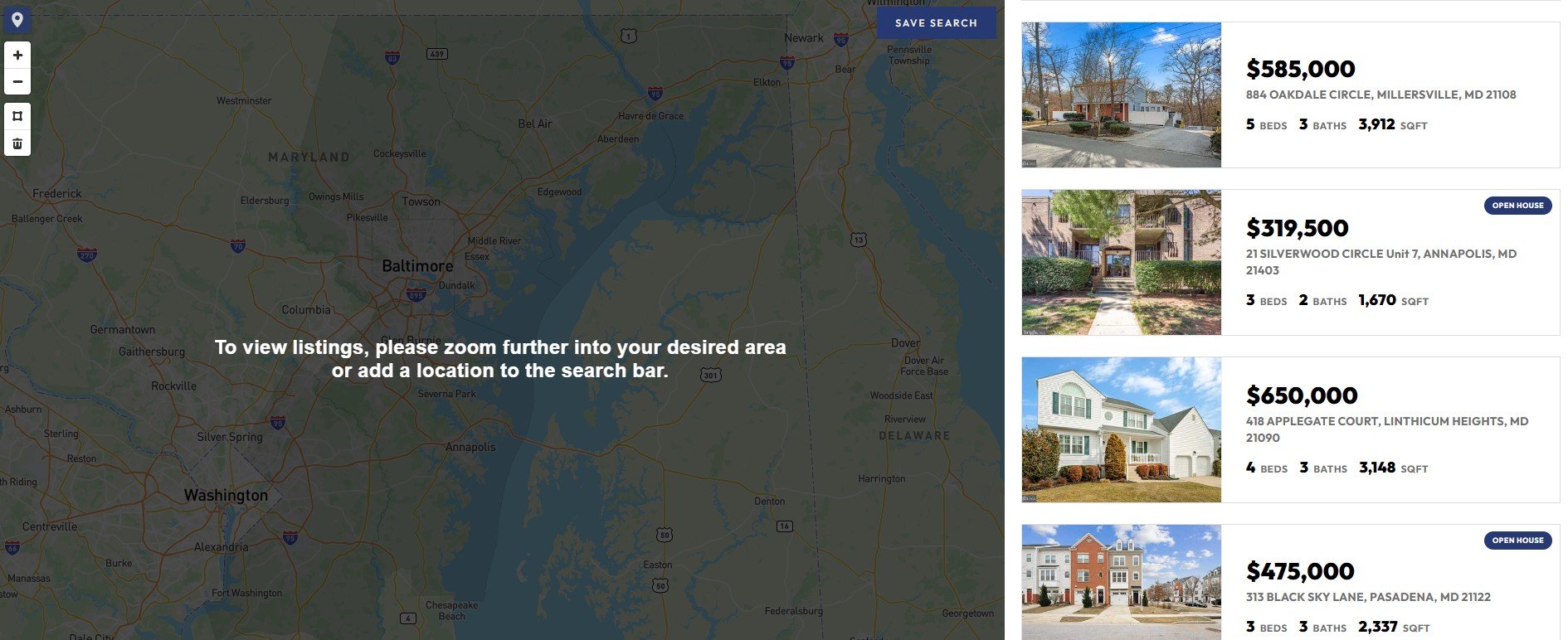

Step 4: Start Your Home Search

Consider your must-have features, preferred locations, and budget.

Maryland offers diverse housing options, from suburban communities to waterfront properties.

Use online listings, attend open houses, and work with your agent to find the perfect home.

To access exclusive Maryland Listings with the professional assistance of local experts click here.

Step 4: Make an Offer

Once you find a home you love, work with your real estate agent to make a competitive offer.

Sellers may receive multiple offers, so consider factors like:

- Offering slightly above the asking price in a competitive market

- Including a personalized letter to the seller

- Being flexible on closing dates

Step 6: Schedule a Home Inspection

The more accessible your home is, the faster it will sell.

Being open to last-minute showings and weekend tours will increase your chances of finding the right buyer quickly.

Keep your home clean and ready for viewings at all times.

Step 7: Secure Financing

After your offer is accepted, your lender will finalize your loan application.

This includes an appraisal, final credit check, and underwriting process.

Once approved, you’ll receive a closing disclosure outlining your loan terms.

Step 8: Close on Your New Home

On closing day, you’ll sign the necessary paperwork, pay closing costs, and officially become a homeowner.

Closing costs in Maryland typically range between 2-5% of the home’s purchase price.

Step 9: Move In and Settle

Once you receive your keys, start preparing for your move.

Transfer utilities, update your address, and plan your home improvements if needed.

Frequent Questions About Buying a Home in Maryland

What credit score do I need to buy a home in Maryland?

Most lenders require a credit score of 620 or higher for a conventional loan. However, FHA loans may accept lower scores. The minimum credit score required for a mortgage depends on the type of loan:

- Conventional Loan: Typically 620+

- FHA Loan: Minimum 500 with a 10% down payment, but 580% for a 3.5% down payment

- VA Loan: No official minimum, but most lenders prefer 580-620+

- USDA Loan: Usually 640+

- Jumbo Loan: Typically 700+

Lenders may have their own requirements beyond these minimum, and higher scores usually mean a better interest Rate. We have our preferred list of local lender recommendations for you to speak too!

How much do I need for a down payment?

Down payments vary depending on the loan type.

- Conventional loans require as little as 3% down

- FHA loans require as little as 3.5% down

- VA loans require as little as 0% down

- USDA loans require as little as 0% down

Are there first-time homebuyer programs in Maryland?

Yes! Maryland offers programs like Maryland SmartBuy, MMP (Maryland Mortgage Program), FHLB, Harford County SELP, and many more which provide assistance with down payments and closing costs. Some of these funds are limited as they are first come, first serve!

What are typical closing costs in Maryland?

Closing costs in Maryland usually range between 2-5% of the home price and include lender fees, title insurance, transfer and recordation taxes.

How long does it take to Buy a House in Maryland?

The process typically takes 30-60 days from offer acceptance to closing, depending on financing and inspection timelines. However, our preferred loan officers have been able to close loans in as little as 14 days!

Maryland Home Buying Conclusion

Buying a home in Maryland is a rewarding journey that requires careful planning.

By following these 10 steps to buy a home in Maryland, you will be well prepared for a smooth and successful purchase.

Ready to start? Begin your home search today!? Contact us now by clicking here.

Next Steps for Homebuyers

Next Steps for Maryland Homebuyers:

- Connect with a local real estate agent for expert guidance.

- Get pre-approved for a mortgage to know your budget.

- Start browsing Maryland home listings today.

If you’re ready to get qualified homebuyers and sell your house effectively and profitable, contact KN Home Group today.

Our team is ready to help you sell your property!