Buying your first home in Maryland in 2025 means navigating a market that is finally offering some relief. Inventory has improved, bidding wars have eased across many price points, and several counties now offer stronger value and more approachable entry-level options. But Maryland is a diverse state, and what you can afford — and what your home will be worth in the long run — varies dramatically depending on the county you choose.

This guide highlights the Maryland counties that provide the strongest advantages for first-time buyers in 2025. These counties offer a combination of affordability, inventory, location, amenities, and long-term stability that makes them ideal for new homeowners stepping into the market.

This guide highlights the top Maryland counties for first-time homebuyers in 2025. These locations offer strong schools, reasonable property taxes, a healthy supply of homes, and competitive pricing that appeals to new buyers navigating the current market.

2. Harford County

Harford County remains one of the most attractive areas for first-time homebuyers because it consistently balances affordability, space, and convenience better than many other counties in central Maryland. Harford gives buyers more square footage and backyard space for the price — something first-time buyers often struggle to find closer to major metro areas.

Why Harford County Works for First-Time Buyers:

Home prices are competitive compared to nearby counties, especially for townhomes and starter single-family homes.

Strong selection of neighborhoods that appeal to a wide range of buyers.

Reasonable commute times to Baltimore and APG combined with lower overall cost of living.

Solid school districts and community amenities that support long-term value.

Areas to consider: Abingdon, Bel Air, Edgewood, Havre de Grace

2. Baltimore County

Baltimore County is one of the most versatile options for first-time homebuyers in Maryland. It offers a broad mix of price points, home styles, and neighborhoods — many of which are well within reach for someone entering the market for the first time. Baltimore County is ideal for first-time buyers who want suburban convenience without stretching into higher-priced counties like Howard or Anne Arundel.

Why Baltimore County Works:

Townhomes under $350,000 remain widely available in key commuter corridors.

Close proximity to major employers, universities, hospitals, and Baltimore City’s job market.

Strong access to transit, major highways, and suburban amenities.

Lower property taxes than Baltimore City while still offering plenty of nearby convenience.

Areas to consider: Parkville, Dundalk, Rosedale, Middle River, Catonsville

3. Anne Arundel County

Anne Arundel has a higher price point than some neighboring counties, but first-time buyers who can make the numbers work benefit from a county with strong appreciation, steady demand, and exceptional convenience. First-time buyers purchasing here often do so with an eye toward future equity gains and long-term stability.

Why Anne Arundel Works:

Central location between Washington, D.C., Baltimore, and Annapolis.

High demand from federal and tech employees ensures long-term resale strength.

A variety of starter-home options in areas like Glen Burnie, Severn, and Odenton.

Mix of urban, suburban, and waterfront living depending on budget.

Areas to consider: Glen Burnie, Pasadena, Severn, Odenton

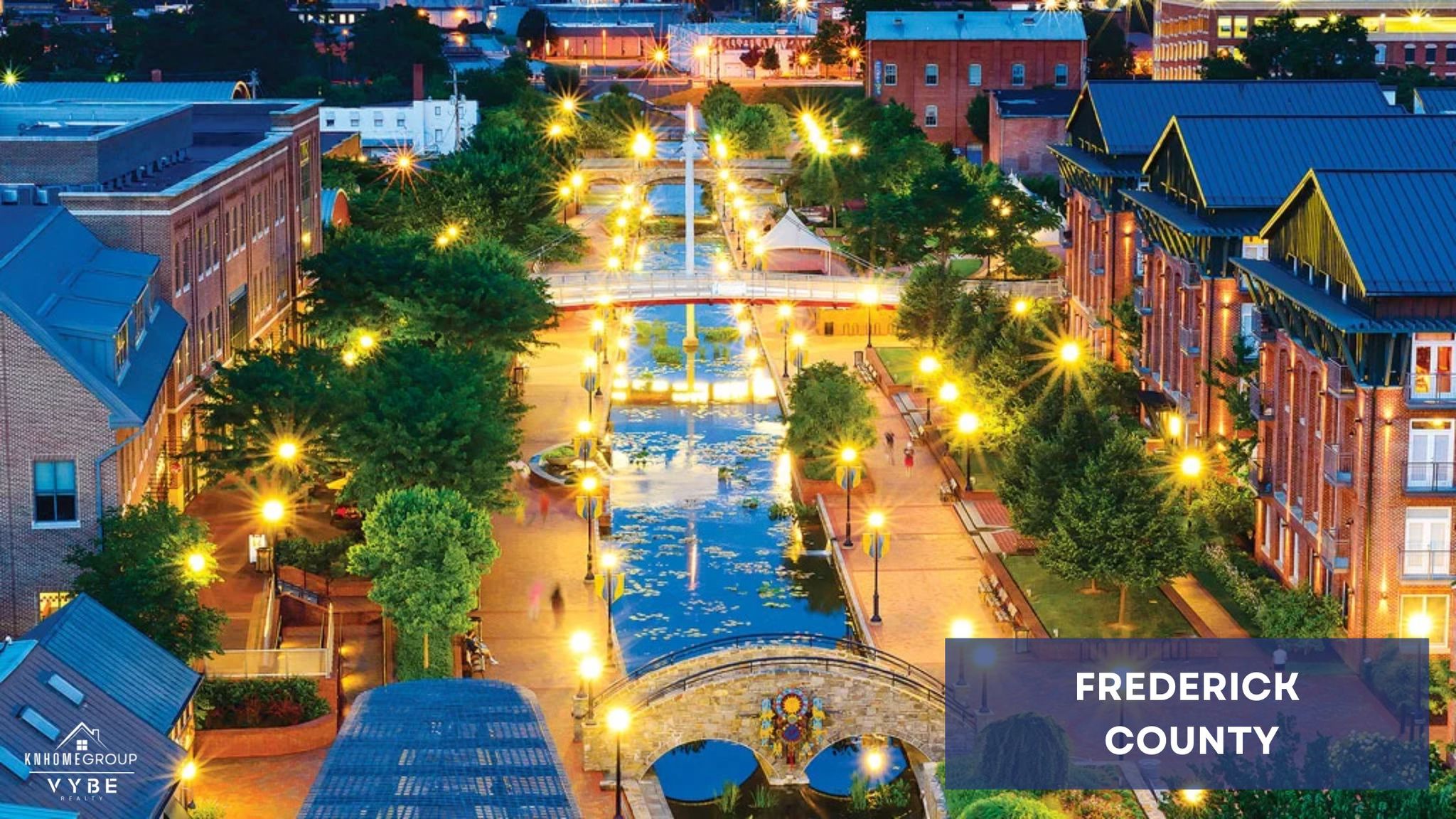

4. Frederick County

Frederick County continues to grow rapidly and remains a strong choice for first-time buyers seeking a mix of affordability, space, and newer construction. For first-time buyers wanting a suburban environment with a strong community feel, Frederick is one of Maryland’s best options.

Why Frederick County Works:

Many new and recently built communities with modern layouts and energy-efficient designs.

Home prices offer relief compared to Montgomery and Howard Counties while still providing strong appreciation potential.

Attractive for hybrid and remote workers who only commute a few days a week.

Expanding job opportunities and lifestyle amenities around Frederick City.

Areas to consider: Frederick, Walkersville, Brunswick, New Market

5. Cecil County

Cecil County offers some of the most affordable housing options in the state, making it a natural fit for first-time buyers trying to keep their monthly payment manageable. Cecil is ideal for buyers looking for affordability and space, as long as commute times are manageable.

Why Cecil County Works:

Lower median home prices create opportunities for FHA, VA, and USDA buyers.

Rural and suburban mix appeals to buyers wanting more land or a quieter lifestyle.

Proximity to I-95 makes commutes to Baltimore, Aberdeen, Delaware, and even Pennsylvania possible.

Smaller towns with a strong sense of community.

Areas to consider: Elkton, Perryville, North East, Rising Sun

Key Factors First-Time Buyers Should Consider in 2025

Regardless of the county, first-time buyers should weigh the following:

Price vs. Total Monthly Cost

Counties differ in property tax rates, HOA fees, and insurance costs, all of which affect affordability beyond the list price.

Commute Realities

Hybrid schedules have expanded buying options. Buyers moving from city to suburb or suburb to rural may find far more value.

Down Payment and Grant Programs

Many Maryland counties offer additional incentives on top of the Maryland Mortgage Program (MMP). In certain areas, buyers can stack incentives to lower out-of-pocket costs significantly.

Future Resale Strength

Even first-time buyers should consider long-term demand. Counties with job growth, strong schools, or expanding infrastructure typically see better appreciation.

The Bottom Line

2025 is one of the most favorable years for first-time homebuyers that Maryland has seen in some time. With more inventory, easing competition, and steady pricing across many counties, buyers have real choices — and their money goes further than it did during peak bidding-war years.

Harford, Baltimore County, Anne Arundel, Frederick, and Cecil Counties all provide compelling options depending on your budget, lifestyle, commute, and long-term goals. The key is identifying the county that aligns with what matters most to you — whether that’s price, convenience, space, schools, or appreciation potential.

Start Your Home Search With KNHome Group

KNHome Group of Vybe Realty helps first-time buyers across Maryland understand their best options by county, explore grants and incentives, and navigate the purchasing process with clarity and confidence.

Visit KNHomeGroup.com to start planning your first home purchase today.